single life annuity vs lump sum

The annuity allows you to collect your winnings in 30 payments over 29 years but those payments are not divided into 30 even chunks. This means that the annuity will.

Annuities 101 Most Commonly Asked Questions And Answers Usaa

Annuity vs Lump Sum.

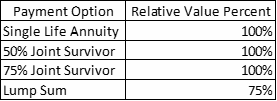

. 50 joint and survivor annuity. Life annuity with 10 years certain. The decision between cash up front and.

Should you Choose Lump Sum or Annuity at Retirement. Unlike annuity payments that require you to pay tax each year when you receive your annuity cash lump sums are only taxed oncewhen they are paid out. If you add a beneficiary under a joint-and-survivor option the monthly.

The annuity on the other hand would pay out the. Lottery winners can collect their prize as an annuity or as a lump-sum. The lump sum payment will be less money than the reported jackpot because the total amount is subject to income tax for that year Your money could run out if not managed.

Whether the winner would choose an annuity or the reduced lump sum taxes would take a big bite out of the prize. SPIAs are commodities that need to be. Your lump sum vs annuity decision comes down to if you need a lifetime income stream or not.

A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. One option for your pension payout is to receive your entire pension as a single lump sum payment. The biggest difference between the two options is that the lump sum is a one-time payment while the annuity is a series of payments.

Single life annuity. The selection of an annuity or lump sum retirement plan primarily depends on your goals for your retirement and. Statistics show that sticking with an annuity is often the wisest move for a lot of Americans.

Individuals who already have sufficient income sourcesthrough Social Security other pension benefits or a large portfolio might find an. According to the North Carolina Education Lottery a winner that chooses the lump sum would get 9291 million before taxes. If You Must Go with an Annuity Single-Life Option Gives You More Control.

100 joint and survivor annuity. Lifetime income A guaranteed lifetime withdrawal benefit provides. The cash option for this jackpot is 7824 million just under half.

According to reports retirees with. Projected annual income needs. A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life.

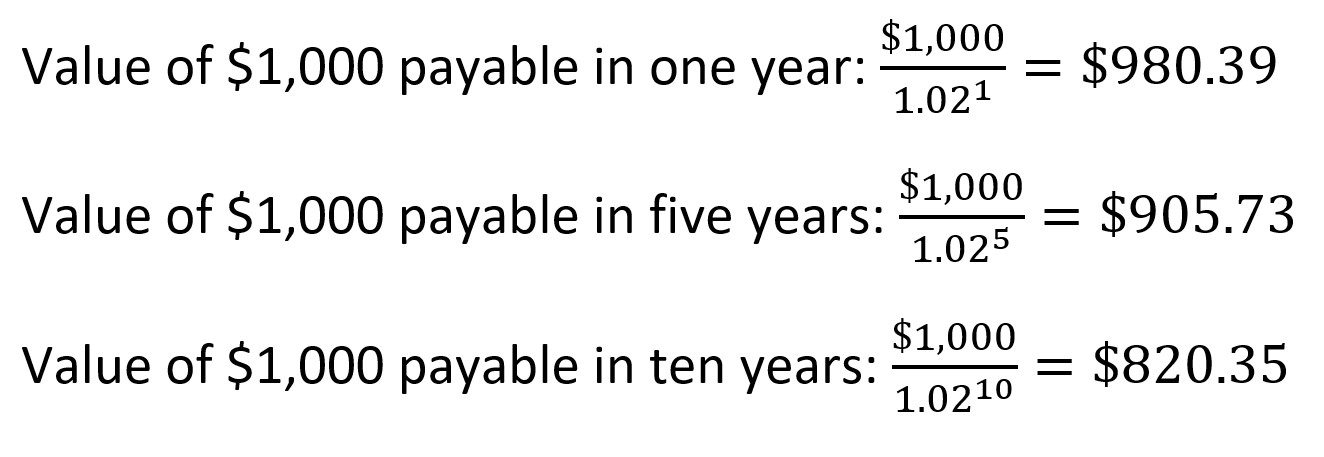

The savings interest rate that you designate is used to calculate present value for the annuity payment option and is compounded monthly. Often referred to as a lottery annuity the annuity option provides annual payments over time. A single-life annuity with no period-certain option will generally give you the largest monthly payment.

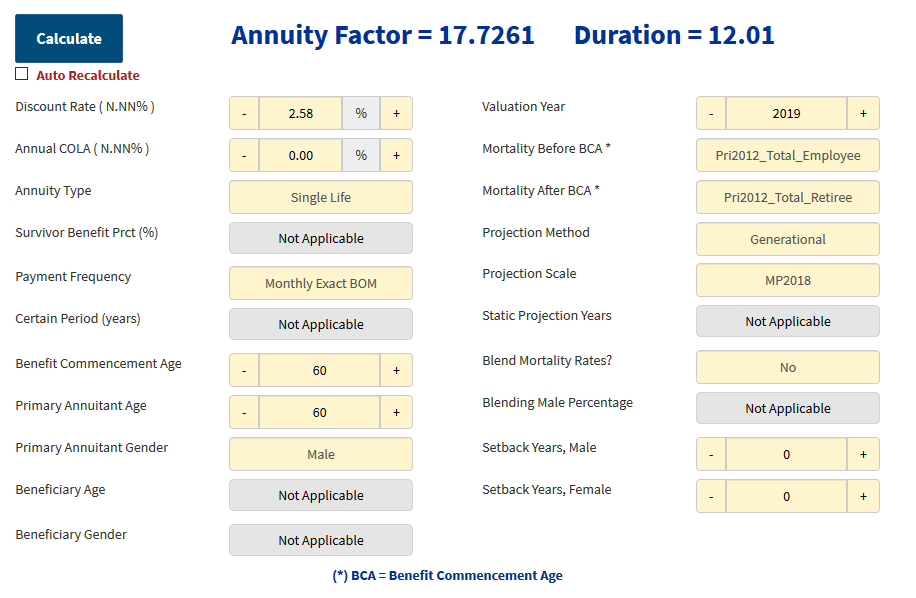

The lump sum option means that your pension administrator would send you a one. Annuities are the only retirement plan that can provide guaranteed income for life even if the annuity runs out of money. Your company gives you a choice of a 300000 lump sum or 2000 a month in a single-life annuity.

Regardless of what your financial advisor or agent recommends. While this tax may take a rather. Each payment is supposed to.

If you do need. With a lump sum your purchasing power will decrease as prices increase. Both options offer retirees.

Of course not all pensions have a lump sum option which means you have no choice but to.

The Anatomy Of A Lump Sum Conversion

What Is A Single Life Annuity Due

Lump Sum Vs Annuity Which Should You Take Youtube

Annuity Vs Lump Sum What S The Right Choice

Strategies To Maximize Pension Vs Lump Sum Decisions

Lump Sum Vs Annuity Which Should You Take Smartasset

Annuity Vs Lump Sum What S The Right Choice

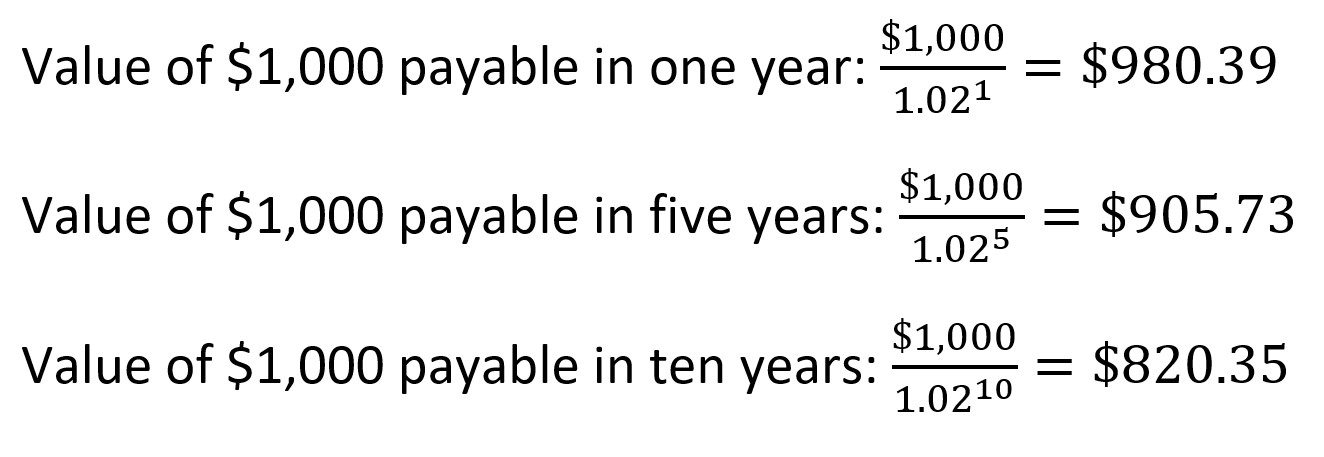

Bonding With Deferred Income Annuities Br Exploring Portfolio Sustainability Options In Retirement Immediateannuities Com

Lottery Payout Options Annuity Vs Lump Sum

Spia Single Premium Immediate Annuity Forbes Advisor

Annuity Vs Lump Sum Lottery Payout Options

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

How A Single Life Annuity Will Impact Your Retirement Due

Pension Choices Lump Sum Single Life Or Joint Survivor

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Taking Cash Vs Powerball Annuity Payout Magnifymoney

New York Life Annuity Immediate Annuity

Pension Lump Sum Payout Vs Monthly Annuity Keil Financial Partners